VANCOUVER, British Columbia, April 26, 2024 (GLOBE NEWSWIRE) — West Red Lake Gold Mines Ltd. (“West Red Lake Gold” or “WRLG” or the “Company”) (TSXV: WRLG) (OTCQB: WRLGF) announces an updated Mineral Resource Estimate (“MRE“) effective as of March 1, 2024, on its 100% owned Rowan Mine Deposit, located in the Red Lake Gold District of Northwestern Ontario, Canada.

- Indicated resources of 476,323 tonnes grading 12.78 grams per tonne (“g/t“) gold (“Au“), for a total of 195,746 ounces (“oz“) Au.

- Inferred resources of 410,794 tonnes grading 8.76 g/t Au, for a total of 115,719 oz Au.

KEY TAKEAWAYS:

- The 2024 MRE has added a significant portion of higher confidence Indicated ounces at grades 40% higher than the 2022 MRE.

- Relative to the 2022 Rowan MRE, there was a decrease in the Inferred mineral resources from approximately 827,000 ounces to 116,000 ounces and an increase in Indicated mineral resources from zero to approximately 196,000 ounces. The drop in Inferred metal content is mainly attributed to 1) conversion of Inferred to Indicated resources, 2) a more rigorous modeling approach, and 3) more stringent resource estimation parameters implemented to account for the high gold grades typically seen at Rowan.

- The integration of oriented drilling data and top-to-bottom geochemical analysis allowed the team to reconstruct the geological interpretation at Rowan, resulting in a more tightly constrained, higher-grade resource that should lend itself more effectively to any future reserve calculation and underground mining design.

- A $4.5M drill program is planned and fully funded for up to 15,000m of drilling at Rowan in 2024, focused on growth and resource expansion on the main Rowan Mine deposit.

Shane Williams, President & CEO, stated, “The 2024 Rowan MRE model represents a complete reinterpretation of the structural controls on mineralization and reflects a more conservative estimation approach in-line with industry best practices. When drilling off structurally complex high-grade gold systems that contain significant amounts of coarse gold, it is essential to have a solid understanding of the geology and controls on mineralization early in the process. We are very encouraged to see a significant portion of higher confidence Indicated resources come from this MRE update – and at grades 40% higher than the 2022 MRE. The objective for this year at Rowan will be growth, and we continue to see significant potential for expanding this deposit at depth and along strike.”

ROWAN 2024 MINERAL RESOURCE ESTIMATE:

- The 2024 MRE update for Rowan incorporated an additional 62 holes for 20,211.4m of oriented NQ diamond drill core since the December 2022 MRE.

- A total of twenty-six (26) mineral domains were created to constrain the mineralization.

- For more detailed information on the Rowan 2024 MRE model please refer to the Technical Report entitled “Updated Mineral Resource Estimate for the Rowan Property, Ontario, Canada” dated April 26, 2024 and filed contemporaneously with this press release on April 26, 2024, prepared for WRLG by Sims Resources, LLC (the “Technical Report”), copies of which can be found on SEDAR+ at www.sedarplus.ca.

TABLE 1. Summary of the Rowan 2024 Mineral Resources as of April 26, 2024

| Mineral Resource Statement – Rowan Mine Deposit | |||

| Classification | Tonnes (t) | Gold Grade (g/t) | Gold Troy Ounces (oz Au) |

| Indicated | 476,323 | 12.87 | 195,746 |

| Inferred | 410,794 | 8.76 | 115,719 |

Notes:

1) CIM (2014) definitions were followed for Mineral Resources.

2) Mineral Resources were estimated at a gold cut-off grade of 3.80 g/t using a long-term gold price of $1,800 USD per ounce.

3) Density used for the estimation on all domains was set at 2.8 g/cm^3.

4) There are no Mineral Reserves currently estimated at the Rowan Project.

5) Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

6) Mineral Resources are reported within vein wireframes at the stated cut-off grade of 3.80 g/t Au.

7) The effective date of the Mineral Resources is March 1, 2024.

FIGURE 1. Plan view image comparing the 2022 MRE domains to 2024 MRE domains.

DISCUSSION

The Rowan Vein System has been the focus of most of the exploration on the Property since the initial discovery of four sub-parallel narrow veins on the surface at “Discovery Hill.” Since then, these veins have been drifted upon from the underground on three levels and extensively drilled, including 62 drill holes for 20,211.4m in 2023. The drilling completed at the Rowan Mine deposit in 2023 focused on validating historical data across the Inferred Resource, and also infilling apparent gaps in the analytical data set which was a product of very selective sampling techniques implemented during previous drilling campaigns.

The overall deposit consists of numerous, narrow, high-grade quartz veins that define an east-northeast trending corridor, approximately 150 m wide. This corridor mainly transects the lower mafic to intermediate metavolcanic units of the Ball assemblage in the hinge of the property scale antiform and appears to dissipate once it intersects the unconformity with the metasedimentary Slate Bay assemblage to the east.

The best gold grades often occur when coarse and visible native gold is present. This occurs within distinct 10 cm to 30 cm up to a meter of bluish to grey, glassy quartz veins/stringer zones. Rarely do these individual veins exceed 60 cm wide with alteration halos tending to be localized. Broad zones of diffuse silicification have generally not been found. Trace to 1% pyrite and pyrrhotite is common within these veins/stringers. Less common but a better positive indicator of gold grade is the occurrence of sphalerite, galena, arsenopyrite, and chalcopyrite. Generally total sulphides make up less than 2%. Metallurgical tests indicate favorable recovery characteristics.

The previous interpretation of the Rowan Vein System was that the veins were emplaced after D2 and were essentially undeformed and highly continuous over hundreds of meters. With the benefit of tighter drill spacing and oriented core following the 2023 WRLG drill campaigns, this interpretation is no longer tenable. Strictly planar vein continuity could no longer be demonstrated since east-west trending veins appeared to line up along east-northeast trends.

Modelling such complex geological shapes as transposed vein systems can be achieved using implicit methods in Leapfrog provided enough closely spaced data are present to capture the variability of the deformed vein geometries. This method is being used successfully at the Madsen mine.

The result is a much more realistic model of the vein system that agrees with the structural observations at the deposit and core scales, and that aligns with the structural setting and controls seen at other deposits within the belt, such as at the Madsen mine and Red Lake mines.

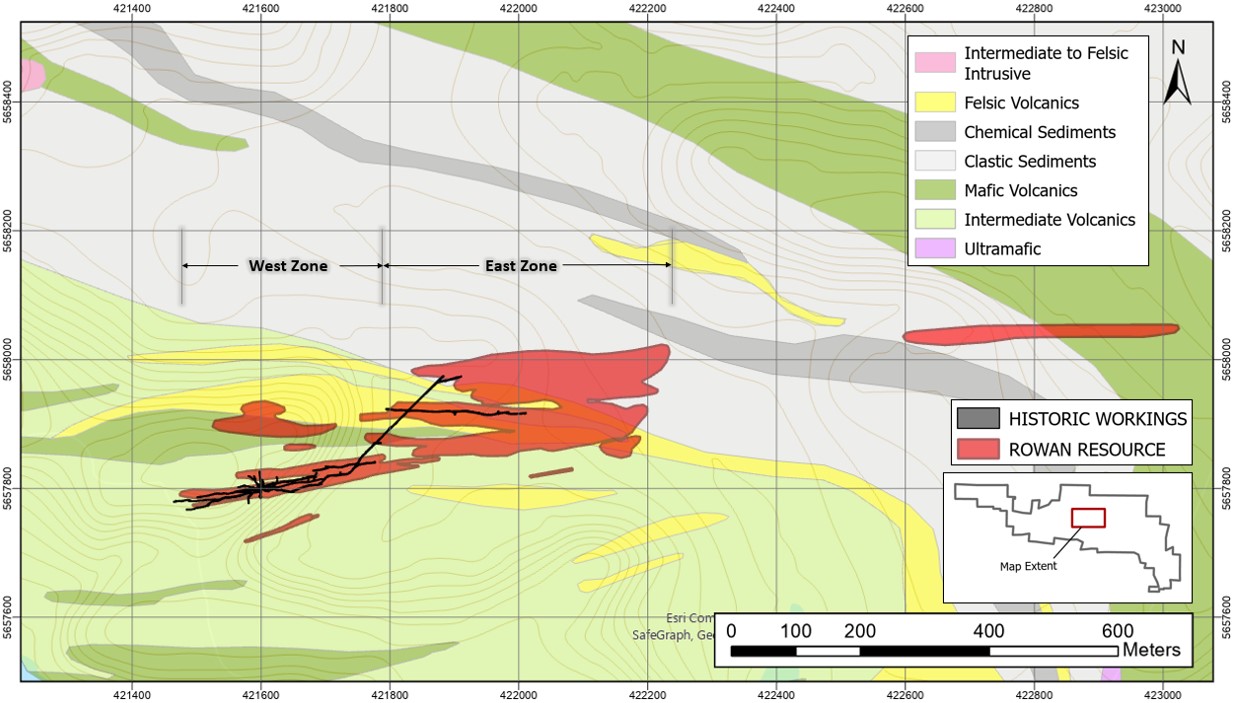

FIGURE 2. Plan view of Rowan deposit projected to surface, with a transparent geology overlay.

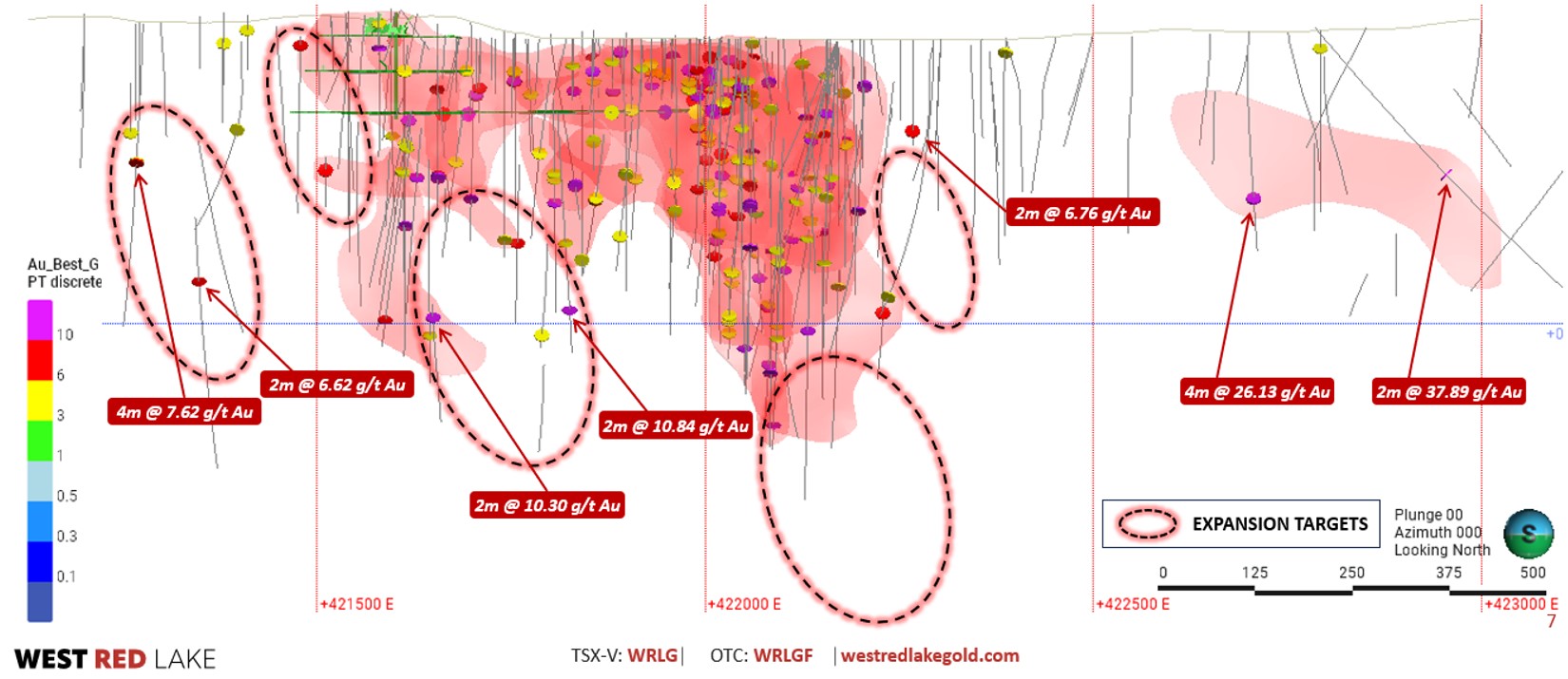

FIGURE 3. Rowan Deposit longitudinal section showing high-priority expansion target areas for 2024 drill program[1]. Drill intercepts shown in this figure have been composited to 2m intervals.

QUALITY ASSURANCE/QUALITY CONTROL

Drilling completed at the Rowan Property consists of oriented NQ-sized diamond drill core. All drill holes are systematically logged, photographed, and sampled by a trained geologist at WRLG’s Mt. Jamie core processing facility. Samples are then prepped by SGS, which consists of drying at 105°C and crushing to 75% passing 2mm.

West Red Lake Gold’s Rowan Property presently hosts a National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) Indicated Mineral Resource of 473,974 t at an average grade of 12.87 g/t Au containing 196,120 ounces of gold, and an Inferred Mineral Resource of 379,571 t at an average grade of 8.49 g/t Au, with a cut-off grade of 3.8 g/t Au (as set out in the Technical Report).

For a better understanding of the Rowan deposit, readers are encouraged to read the Technical Report and other public disclosure of the Company, including all qualifications, assumptions, exclusions, and risks that relate to the Mineral Resource and Mineral Reserve estimates.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for exploration at the West Red Lake Project, as defined by NI 43-101. Mr. Robinson is not independent of West Red Lake Gold.

ABOUT WEST RED LAKE GOLD MINES

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines – Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

“Shane Williams”

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Freddie Leigh

Tel: (604) 609-6132

Email: investors@westredlakegold.com or visit the Company’s website at

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute “forward-looking information” within the meaning of applicable securities laws. Forward-looking information generally can be identified by words suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release.

For more information on the Company, investors should review the Company’s continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/de8439be-138f-47cb-aa4a-ad10fcc6da97

https://www.globenewswire.com/NewsRoom/AttachmentNg/e8ba13a8-5ec7-45cb-b390-e25624b0b889

https://www.globenewswire.com/NewsRoom/AttachmentNg/ad458356-0622-426c-b41c-71941c10c9d6

https://www.globenewswire.com/NewsRoom/AttachmentNg/4b116511-5870-4e56-a9ee-d1021dc82c26

1 Mineral Resources are estimated at a cut-off grade of 3.8 g/t Au and using a gold price of US$1,800/oz. Please refer to the technical report entitled “Updated Mineral Resource Estimate for the Rowan Property, Ontario, Canada” dated April 26, 2024 prepared for WRLG by Sims Resources, LLC.

###