bodnarchuk/iStock via Getty Images

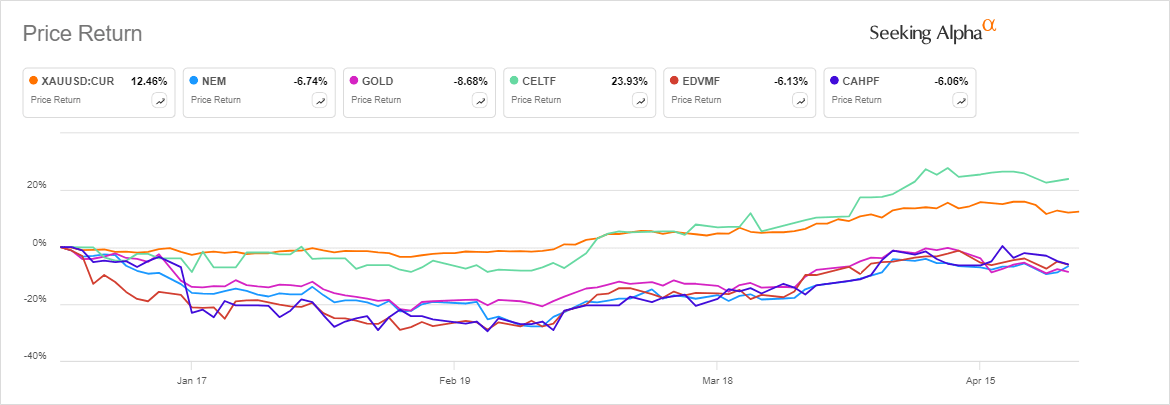

Gold miners have failed to match a blistering rally in gold recently, lagging behind due to respective challenges and rising costs.

Current Market Analysis

Gold stocks appear inexpensive and have abnormally lagged the gold price, UBS said in an analysis on Wednesday, adding that they are trading on a P/E relative that is 40% below its norm.

The stocks have also decoupled from gold prices and should have been up 45% if they had followed their normal relationship with gold prices, the brokerage explained.

UBS Head of U.S. Equity Derivatives Research Maxwell Grinacoff believes investor positioning in gold mining stocks is not fully reflecting the price action in the safe haven metal recently, and could be due for a catchup.

On the day, spot gold (XAUUSD:CUR) was trading +0.52% higher at $2,328.32 an ounce.

Investment Recommendations

The investment bank calls on investors to continue to be overweight gold stocks and names the following as its preferred gold miners globally (year-to-date price performance):

- Anglogold Ashanti (NYSE:AU) +20%

- Barrick Gold (NYSE:GOLD) -7.6%

- Centamin (OTCPK:CELTF) +24%

- Endeavour Mining (OTCQX:EDVMF) -5%

- Evolution Mining (OTCPK:CAHPF)-6%

ETFs: (GLD), (GDX), (GDXJ), (IAU), (NUGT), (PHYS), (GLDM), (AAAU), (SGOL), (BAR), (OUNZ), (SLV), (PSLV), (SIVR), (SIL), (SILJ)

More on AngloGold Ashanti, Evolution Mining, etc.

### Addition Insight

Gold mining stocks have historically shown to have a strong correlation with the price of gold, yet they are currently lagging, presenting a potential opportunity for investors. It is essential for investors to closely monitor this sector for any shifts in market dynamics that could lead to a significant catch-up in performance. Additionally, keeping an eye on global economic indicators and geopolitical events that may impact the price of gold can provide valuable insights for making informed investment decisions in the gold mining sector.