Gold has long been valued as a safe-haven asset, particularly during economic instability and inflation. For thousands of years, civilizations have valued gold for its intrinsic qualities, which have made it a reliable store of wealth and the basis for currencies. Today, gold remains a key part of consumer portfolios because it holds its purchasing power even when other assets, such as stocks or real estate, may falter.

In recent years, interest in gold has seen significant growth, largely driven by uncertain global economic conditions. The onset of the COVID-19 pandemic in 2020 triggered a surge in gold prices as consumers sought refuge from the volatility of stock markets. Gold prices reached record highs in August 2020, surpassing $2,000 per ounce for the first time. Now, in 2024, gold prices have surged again to new record highs, driven by several factors including looming interest rate cuts, heightened geopolitical risks, and increased central bank buying.

U.S. Perceptions of the Best Long-Term Investments

According to recent data from Gallup, when Americans were asked to identify what they consider the best long-term investment, gold emerged as a popular choice. While real estate and stocks were the top preferences, garnering 36% and 22% of the votes respectively, gold was not far behind, capturing 18% of respondents’ votes. Interestingly, gold outpaced the popularity of other options such as savings accounts, certificates of deposit (CDs), bonds, and cryptocurrencies. Despite the growing interest in newer asset types like cryptocurrencies, gold’s reputation as a stable and secure asset continues to resonate with a sizable portion of the population, particularly in certain parts of the U.S.

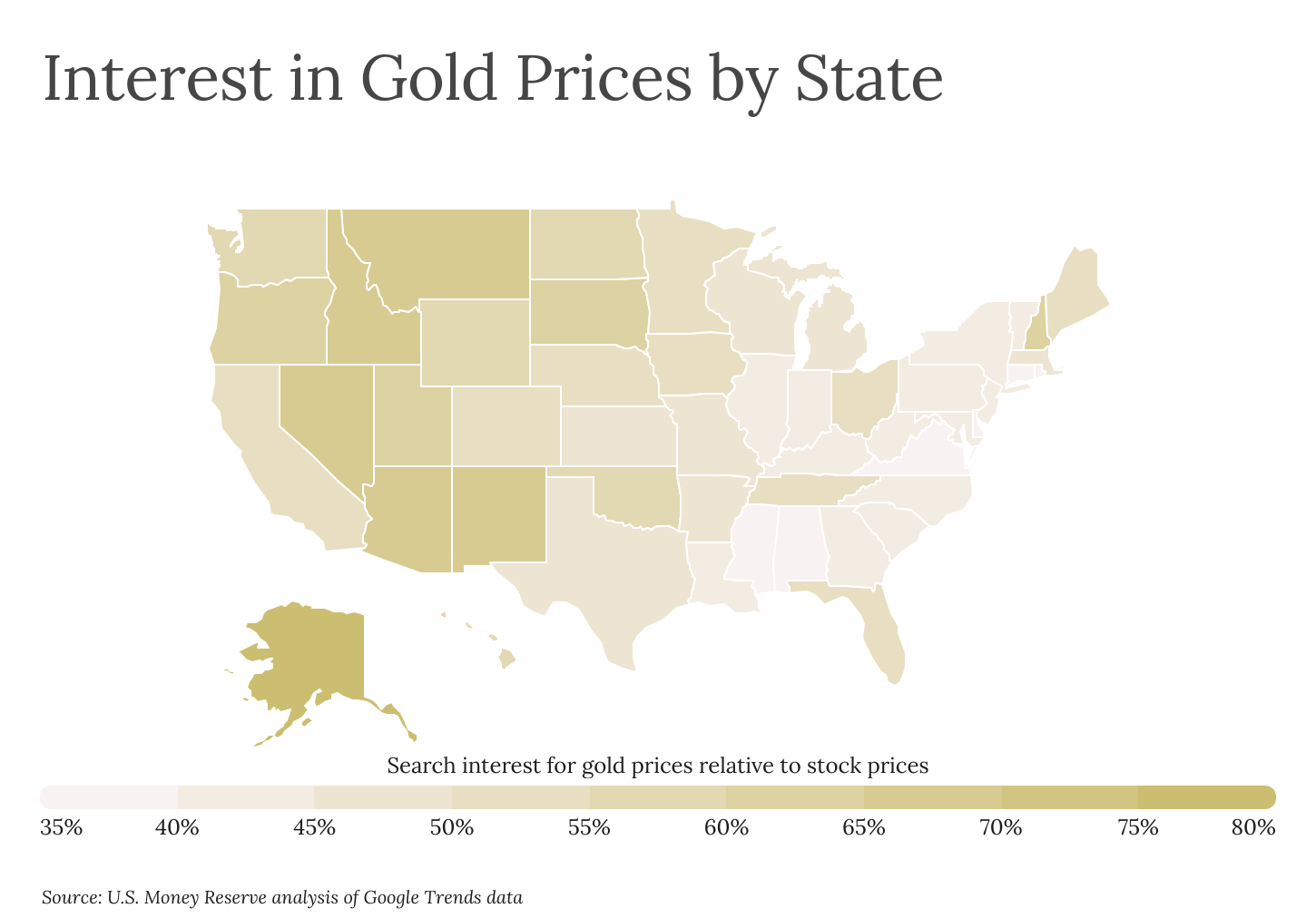

Interest in Gold Prices by State

While the same Gallup poll indicates that gold’s reputation as a reliable asset varies by income and political affiliation, interest in gold also varies regionally. According to data collected from Google Trends over the past five years, residents in the western half of the country—particularly in the Mountain West and Alaska—show a much higher interest in gold relative to stocks when compared to residents in the eastern half of the U.S.

In states like Alaska, internet searches for terms containing “gold prices” outpaced searches for terms containing “stock prices” by a factor of more than three. This high level of interest can be attributed to the state’s rich history of gold mining and its economy, which relies heavily on natural resources. Similarly, states such as Montana, Nevada, and New Mexico also demonstrate a strong inclination toward gold as a financial asset, with approximately twice as many gold-related searches as stock-related searches in recent years.

In contrast, states in the eastern part of the country show a lower interest in gold relative to stocks. For example, residents in Virginia search for stock prices nearly twice as often as gold prices. Similar trends show in Delaware, Rhode Island, and Connecticut. Despite lower interest in gold relative to stocks in eastern states, it’s important to note that gold-related searches still grew in 44 states when comparing search data from 2024 to 2019. Gold-related searches relative to stock-related searches grew by more than 10 percentage points nationally over this five-year period.

This analysis was conducted by U.S. Money Reserve, a leading distributor of government-issued gold, silver, platinum, and palladium, using data from Google Trends. Researchers calculated the share of searches in each state containing the phrase “gold prices” relative to those containing “stock prices” over the study period (2019–2024).

Here is a summary of the data for South Dakota:

- Relative search interest for gold prices: 61%

- Relative search interest for stock prices: 39%

- Change in gold price searches since 2019 (percentage points): +10

For reference, here are the statistics for the entire United States:

- Relative search interest for gold prices: 49%

- Relative search interest for stock prices: 51%

- Change in gold price searches since 2019 (percentage points): +11

For more information, a detailed methodology, and complete results, see Residents of These U.S. States Are More Interested in Gold Than Stocks on U.S. Money Reserve.

**Insight:**

– The rising interest in gold as a long-term investment is not just limited to the U.S. but is a global trend. Countries around the world are seeing a surge in gold prices due to economic uncertainties and geopolitical tensions, highlighting the universal appeal of gold as a safe-haven asset.

– Gold’s historical significance and tangible nature make it an attractive option for investors seeking stability in their portfolios. The physical presence of gold provides a sense of security that digital assets like cryptocurrencies may not offer, especially during times of market volatility.

– The regional variations in interest in gold versus stocks illustrate the diverse investment preferences across different parts of the United States. Understanding these regional trends can help investors tailor their investment strategies to align with the prevailing sentiment in their respective areas.