Could Golf Predict Bitcoin’s Next Bull Run? This intriguing question has been circulating in the crypto community recently.

Charles Edwards, the founder of Capriole Fund, has put forth a theory that has grabbed the attention of many. Notably, Bitcoin investor Lark Davis recently shared Edwards’ insights in a video on X, sparking discussions within the community.

Let’s delve into the details and explore this interesting concept further.

A Surprising Connection Between Gold and Bitcoin

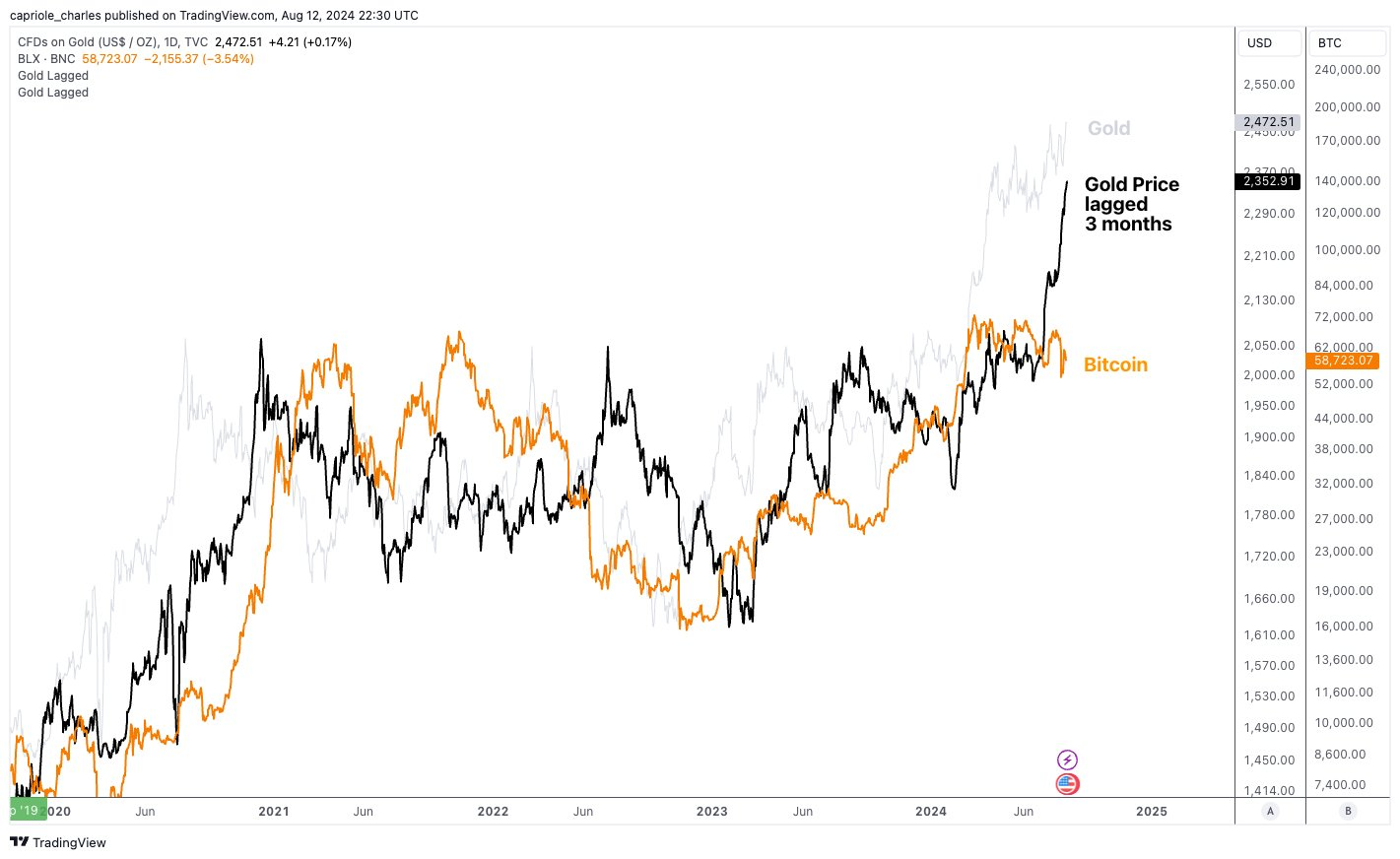

Despite being distinct asset classes, Edwards has identified a significant correlation between the price movements of gold and Bitcoin. He notes that the major trends of Bitcoin often mirror those of gold, albeit with a slight delay of a few months.

In essence, Edwards suggests that if the price of gold goes up, Bitcoin’s value could also see an increase after a few months.

Lark Davis Highlights the Theory

Lark Davis, a prominent Bitcoin investor, has echoed Edward’s viewpoint through a concise video shared on X. The video encourages viewers to weigh in on Edward’s perspective.

According to the chart presented by Edwards, gold has recently reached a new high. If the theory stands true, we might anticipate an upward movement in the Bitcoin market in the near future.

Current Bitcoin Price Trends

As of now, Bitcoin is valued at $59,650.84. Over the past month, it has experienced a 10.6% decrease, and in the last week, it dipped by 2.0%.

At the beginning of August 2024, Bitcoin kicked off on a positive note, closing at $65,265. However, subsequent days witnessed several sizable red candlesticks on the daily chart. On August 5th, Bitcoin reached a low of $53,987, influenced by a substantial trading volume of $437.756 million.

Despite a long green candlestick emerging on August 8th, it lacked volume support, with only $225.652 million traded—significantly lower than the volume on the day of Bitcoin’s low. The market found support around $57,670 and surged to $64,115 on August 23rd. Nevertheless, two doji candlesticks post this peak indicated persistent selling pressure. Recently, two robust red candlesticks have materialized.

What Next: Is a Bull Rally Coming?

If Edwards’ theory proves accurate, Bitcoin could be gearing up for a notable bullish trend. Presently, the chart does not offer definitive confirmation of this scenario. However, should market sentiment align with this theory, we may observe clear indications of a bullish trend in the upcoming days.

Also Read: Crypto News: These Altcoins Are At Risk of Major Crash

The discussion around the gold-Bitcoin correlation is buzzing in the crypto space. What are your thoughts on this intriguing connection?