Source: Ron Struthers 04/09/2024

There has been a lot of activity in the market. With Bitcoin (CRYPTO: BTC) soaring to old highs and gold breaking out into record hights, Ron Struthers of Struthers Resource Stock Report takes a look at what might be going on.

There has been a lot of activity in the market with Bitcoin soaring back to old highs and a bit more and gold breaking out to record highs.

What is going on?

The Basics

First, let’s delve into the basics of each major asset – Bitcoin, gold, and fiat currency. While Bitcoin has been classified as a cryptocurrency, it is important to note that it does not function as a traditional currency and lacks the universal acceptance and government backing that fiat currencies and gold possess. Fiat currencies, such as the dollar, yen, and euros, are considered Tier one assets that hold value as a medium of exchange and collateral. Central banks typically hold fiat currencies and gold as reserve assets, reinforcing their stability and widespread use in the global economy.

Despite the rise in popularity of cryptocurrencies, such as Bitcoin, their adoption remains limited compared to traditional fiat currencies and gold. The reliance on third-party platforms and digital wallets for cryptocurrency transactions restricts their widespread use. In contrast, the global population readily utilizes physical currencies and gold for various transactions and financial purposes. The market size of Bitcoin, valued at around $1.3 trillion, pales in comparison to the market capitalization of gold and fiat currencies, emphasizing their dominance and liquidity in the financial markets.

Silver, with its historical significance as a form of coinage and industrial applications, also retains value as a currency during periods of economic turmoil. Unlike gold, silver undergoes significant industrial consumption, limiting its availability as a monetary asset. The limited supply of physical silver for investment purposes contributes to its potential as a valuable alternative to fiat currencies and cryptocurrencies in times of crisis.

Gold, with its inherent stability and scarcity, serves as a premier currency that transcends government control and manipulation. Despite the shift away from the gold standard in modern economies, the timeless appeal and value of gold as a store of wealth remain unparalleled. Central banks, despite their public stance on gold, continue to maintain vast reserves of the precious metal, highlighting its enduring role as a financial safeguard against economic uncertainties.

While cryptocurrencies like Bitcoin tout limited supply as a strength, the proliferation of various cryptocurrencies presents challenges to their exclusivity. The emergence of thousands of cryptocurrencies, with a collective market value of around $2 trillion, underscores the competitive landscape and volatility within the digital assets market. In contrast, the enduring value and stability of gold resonate with individuals seeking long-term wealth preservation amidst fluctuating economic conditions.

To summarize, Bitcoin represents a novel financial instrument characterized by volatility, while fiat currencies serve as daily mediums of exchange susceptible to inflation. Gold, on the other hand, stands as a reliable store of value that outperforms traditional assets over extended periods. The historical performance of gold as a secure investment underscores its enduring appeal compared to the speculative nature of cryptocurrencies and fiat currencies.

What’s happening Now?

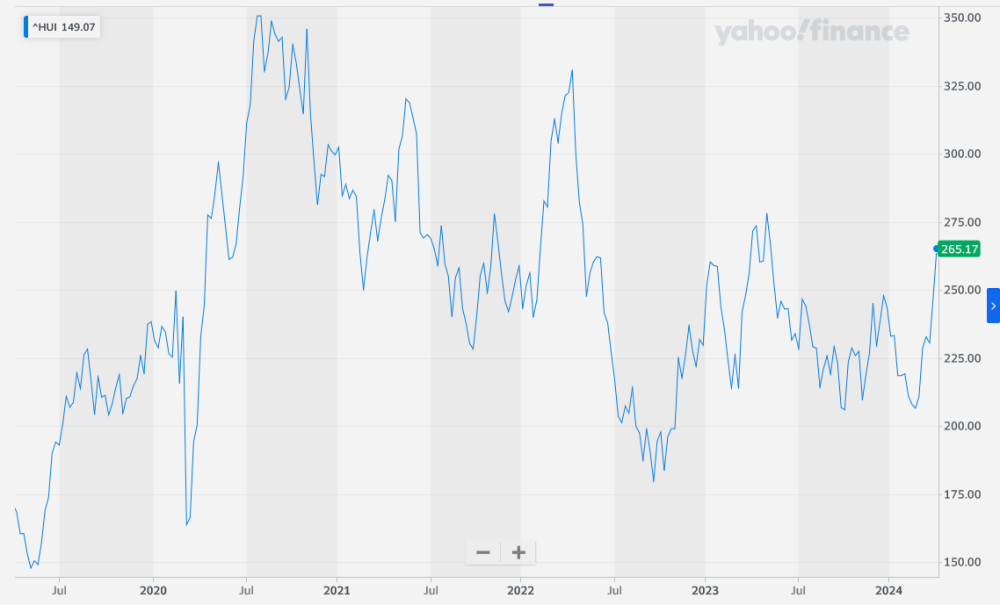

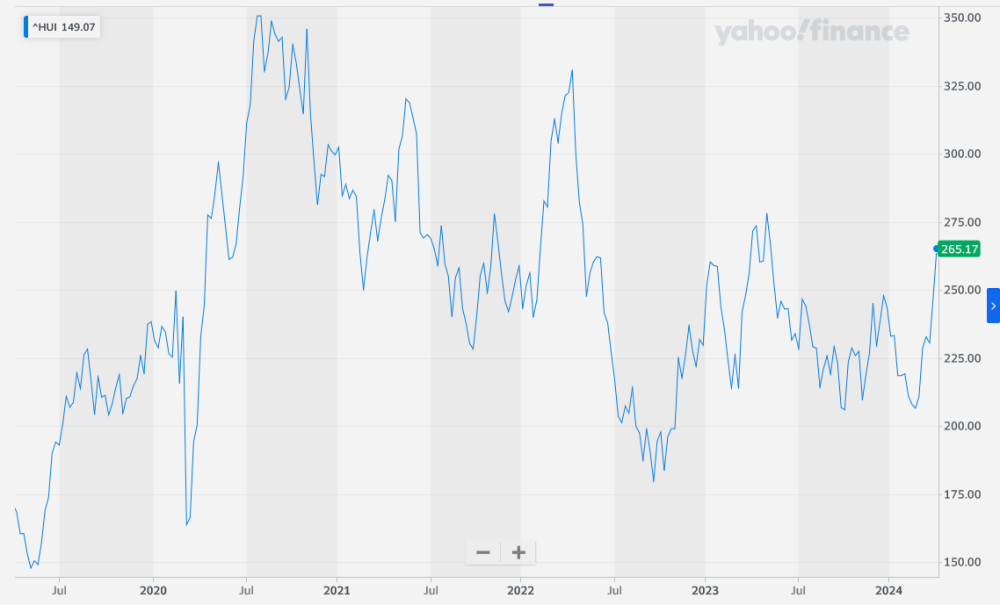

As gold continues to reach new record highs, the absence of significant price intervention indicates a shift in the market dynamics favoring gold. Despite occasional fluctuations, the steady uptrend in gold prices signifies robust demand and investor confidence in the precious metal.

Insight: The current surge in gold prices reflects growing uncertainties in the global economy and mounting inflationary pressures. Investors seeking asset diversification and wealth preservation flock to gold as a safe haven asset during turbulent market conditions.

Furthermore, the gradual increase in gold-related ETF trading activity points to a broader trend of rising interest in gold investments. This understated rally in gold and silver prices suggests a shift towards precious metals as viable investment alternatives amid economic uncertainties.

Insight: The recent uptrend in gold ETF volumes and managed money positions indicate a growing appetite for precious metals as portfolio diversification strategies among institutional investors and individual traders alike.

Examining the long-term devaluation of the US dollar against gold underscores the enduring value of gold amid fluctuating fiat currencies. The sustained erosion of the US dollar’s purchasing power relative to gold highlights the stability and long-term wealth preservation potential of gold as a timeless asset.

Bitcoin – A Short History

Bitcoin’s evolving market dynamics and speculative nature present contrasting narratives to its role as a financial instrument. The recent surge in Bitcoin prices reflects investor optimism and speculation surrounding its value proposition as a digital asset.

Insight: While Bitcoin’s limited supply and halving events contribute to its scarcity, the proliferation of alternative cryptocurrencies and speculative trading practices influence its market dynamics. The hype-driven nature of Bitcoin underscores the speculative sentiment prevailing in the digital assets market.

As investors navigate the evolving landscape of cryptocurrencies and precious metals, the contrasting characteristics of gold, fiat currencies, and Bitcoin provide unique insights into the diverse investment options available. The enduring appeal of gold as a stable store of value, the functionality of fiat currencies for daily transactions, and the speculative nature of Bitcoin collectively shape the contemporary financial ecosystem.

Insight: Diversification across gold, silver, fiat currencies, and digital assets like Bitcoin offers investors a comprehensive approach to portfolio management and wealth preservation amid economic uncertainties and market fluctuations.

As market dynamics continue to evolve, staying informed about the nuances of Bitcoin, gold, and fiat currencies enables investors to make informed decisions and navigate the complexities of the contemporary financial landscape effectively.

Important Disclosures:

- Ron Struthers: I or members of my immediate household or family, own securities of: Silver SLV and Gold GLD. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.

Source: Ron Struthers 04/09/2024

There has been a lot of activity in the market. With Bitcoin (CRYPTO: BTC) soaring to old highs and gold breaking out into record hights, Ron Struthers of Struthers Resource Stock Report takes a look at what might be going on.

There has been a lot of activity in the market with Bitcoin soaring back to old highs and a bit more and gold breaking out to record highs.

What is going on?

The Basics

First, let’s delve into the basics of each major asset – Bitcoin, gold, and fiat currency. While Bitcoin has been classified as a cryptocurrency, it is important to note that it does not function as a traditional currency and lacks the universal acceptance and government backing that fiat currencies and gold possess. Fiat currencies, such as the dollar, yen, and euros, are considered Tier one assets that hold value as a medium of exchange and collateral. Central banks typically hold fiat currencies and gold as reserve assets, reinforcing their stability and widespread use in the global economy.

Despite the rise in popularity of cryptocurrencies, such as Bitcoin, their adoption remains limited compared to traditional fiat currencies and gold. The reliance on third-party platforms and digital wallets for cryptocurrency transactions restricts their widespread use. In contrast, the global population readily utilizes physical currencies and gold for various transactions and financial purposes. The market size of Bitcoin, valued at around $1.3 trillion, pales in comparison to the market capitalization of gold and fiat currencies, emphasizing their dominance and liquidity in the financial markets.

Silver, with its historical significance as a form of coinage and industrial applications, also retains value as a currency during periods of economic turmoil. Unlike gold, silver undergoes significant industrial consumption, limiting its availability as a monetary asset. The limited supply of physical silver for investment purposes contributes to its potential as a valuable alternative to fiat currencies and cryptocurrencies in times of crisis.

Gold, with its inherent stability and scarcity, serves as a premier currency that transcends government control and manipulation. Despite the shift away from the gold standard in modern economies, the timeless appeal and value of gold as a store of wealth remain unparalleled. Central banks, despite their public stance on gold, continue to maintain vast reserves of the precious metal, highlighting its enduring role as a financial safeguard against economic uncertainties.

While cryptocurrencies like Bitcoin tout limited supply as a strength, the proliferation of various cryptocurrencies presents challenges to their exclusivity. The emergence of thousands of cryptocurrencies, with a collective market value of around $2 trillion, underscores the competitive landscape and volatility within the digital assets market. In contrast, the enduring value and stability of gold resonate with individuals seeking long-term wealth preservation amidst fluctuating economic conditions.

To summarize, Bitcoin represents a novel financial instrument characterized by volatility, while fiat currencies serve as daily mediums of exchange susceptible to inflation. Gold, on the other hand, stands as a reliable store of value that outperforms traditional assets over extended periods. The historical performance of gold as a secure investment underscores its enduring appeal compared to the speculative nature of cryptocurrencies and fiat currencies.

What’s happening Now?

As gold continues to reach new record highs, the absence of significant price intervention indicates a shift in the market dynamics favoring gold. Despite occasional fluctuations, the steady uptrend in gold prices signifies robust demand and investor confidence in the precious metal.

Insight: The current surge in gold prices reflects growing uncertainties in the global economy and mounting inflationary pressures. Investors seeking asset diversification and wealth preservation flock to gold as a safe haven asset during turbulent market conditions.

Furthermore, the gradual increase in gold-related ETF trading activity points to a broader trend of rising interest in gold investments. This understated rally in gold and silver prices suggests a shift towards precious metals as viable investment alternatives amid economic uncertainties.

Insight: The recent uptrend in gold ETF volumes and managed money positions indicate a growing appetite for precious metals as portfolio diversification strategies among institutional investors and individual traders alike.

Examining the long-term devaluation of the US dollar against gold underscores the enduring value of gold amid fluctuating fiat currencies. The sustained erosion of the US dollar’s purchasing power relative to gold highlights the stability and long-term wealth preservation potential of gold as a timeless asset.

Bitcoin – A Short History

Bitcoin’s evolving market dynamics and speculative nature present contrasting narratives to its role as a financial instrument. The recent surge in Bitcoin prices reflects investor optimism and speculation surrounding its value proposition as a digital asset.

Insight: While Bitcoin’s limited supply and halving events contribute to its scarcity, the proliferation of alternative cryptocurrencies and speculative trading practices influence its market dynamics. The hype-driven nature of Bitcoin underscores the speculative sentiment prevailing in the digital assets market.

As investors navigate the evolving landscape of cryptocurrencies and precious metals, the contrasting characteristics of gold, fiat currencies, and Bitcoin provide unique insights into the diverse investment options available. The enduring appeal of gold as a stable store of value, the functionality of fiat currencies for daily transactions, and the speculative nature of Bitcoin collectively shape the contemporary financial ecosystem.

Insight: Diversification across gold, silver, fiat currencies, and digital assets like Bitcoin offers investors a comprehensive approach to portfolio management and wealth preservation amid economic uncertainties and market fluctuations.

As market dynamics continue to evolve, staying informed about the nuances of Bitcoin, gold, and fiat currencies enables investors to make informed decisions and navigate the complexities of the contemporary financial landscape effectively.

Important Disclosures:

- Ron Struthers: I or members of my immediate household or family, own securities of: Silver SLV and Gold GLD. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

Struthers Resource Stock Report Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author’s control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.