Gold prices (CM:XAUUSD) have risen 12.7% so far in 2024, driven by ongoing macroeconomic instability. The appeal of gold as an investment has been steadily increasing, with prices surging by over 73% in the past five years since the onset of the COVID-19 pandemic. Adding gold to your portfolio can help with diversification and serve as a hedge against inflation. However, investing in physical gold can be challenging, leading many investors to opt for Gold ETFs as a convenient alternative.

Benefits of Gold ETFs

Investing in Gold ETFs offers various advantages, including liquidity, ease of trading, transparency in gold prices, and cost-effectiveness compared to purchasing physical gold bullion. These benefits make Gold ETFs a popular choice among investors looking to include gold in their investment portfolios without the complexities of owning physical gold.

Comparing Spot Gold ETFs

Using TipRanks’ ETFs Comparison tool, we analyzed and compared three prominent Spot Gold ETFs: SPDR Gold Shares (GLD), iShares Gold Trust (IAU), and SPDR Gold MiniShares Trust (GLDM).

SPDR Gold Shares (GLD)

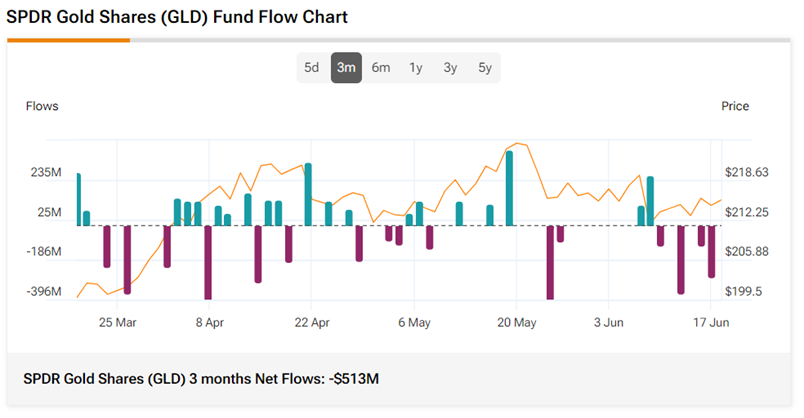

The SPDR Gold Shares ETF, with an AUM of $61.31 billion, is the largest physical gold-backed ETF globally. Despite its higher expense ratio of 0.40%, GLD has shown strong price returns, making it an attractive option for investors seeking exposure to gold. The fund’s performance and significant AUM base position it as a favorable choice for those looking to capitalize on the demand for gold.

SPDR Gold MiniShares Trust (GLDM)

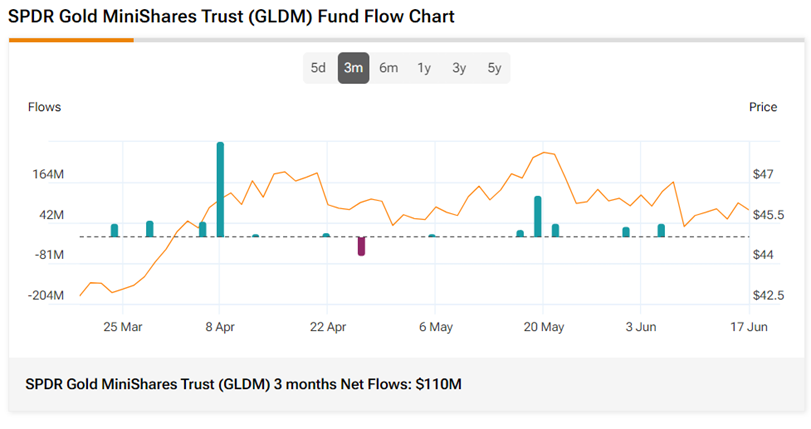

With a lower expense ratio of 0.10% and an AUM of $7.38 billion, the SPDR Gold MiniShares Trust presents a cost-effective option for investors looking to gain exposure to gold. Despite its smaller AUM compared to GLD, GLDM has still delivered solid returns and has seen net inflows in recent months, indicating growing investor interest in the ETF.

iShares Gold Trust (IAU)

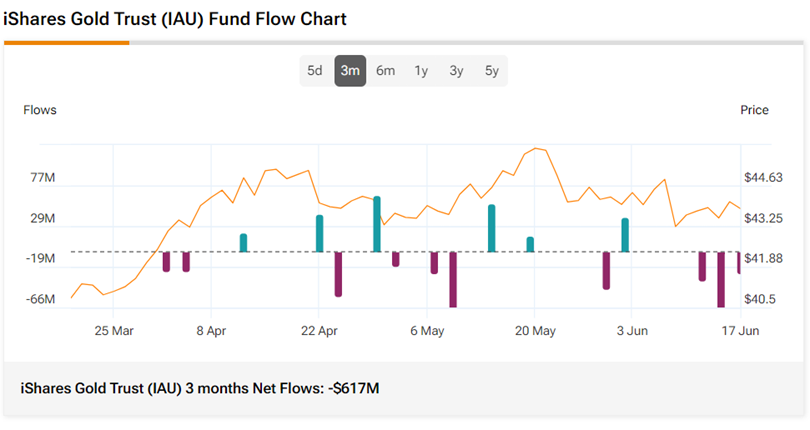

The iShares Gold Trust, with an AUM of $28.40 billion and an expense ratio of 0.25%, offers investors another avenue to invest in gold. While IAU has seen outflows in recent months, its performance metrics are in line with GLD, showcasing its potential as a viable investment option for those interested in gold.

Concluding Thoughts

Overall, the SPDR Gold Shares ETF stands out as a top choice among the three Spot Gold ETFs due to its strong performance metrics and significant AUM base. With the increasing demand for gold, GLD appears well-positioned to attract investors looking to capitalize on the precious metal’s potential.

Disclosure

Additional Insight

When considering Gold ETFs, it’s essential to evaluate not only the historical performance but also the underlying factors driving the price of gold. Geopolitical tensions, economic uncertainty, and inflationary pressures can all influence the value of gold, making it a valuable asset in times of market volatility. Investors should also keep an eye on global economic trends and central bank policies, as they can impact the price of gold and the performance of Gold ETFs in the long term.